Decoding Northrop Grumman Corp (NOC): A Strategic SWOT Insight

Robust sales growth with a significant increase in product sales across all sectors.

Enhanced earnings per share, reflecting operational efficiency and share repurchase strategy.

Strong backlog indicating future revenue potential, despite a termination in the restricted Space business.

Commitment to innovation and defense excellence aligns with current global security needs.

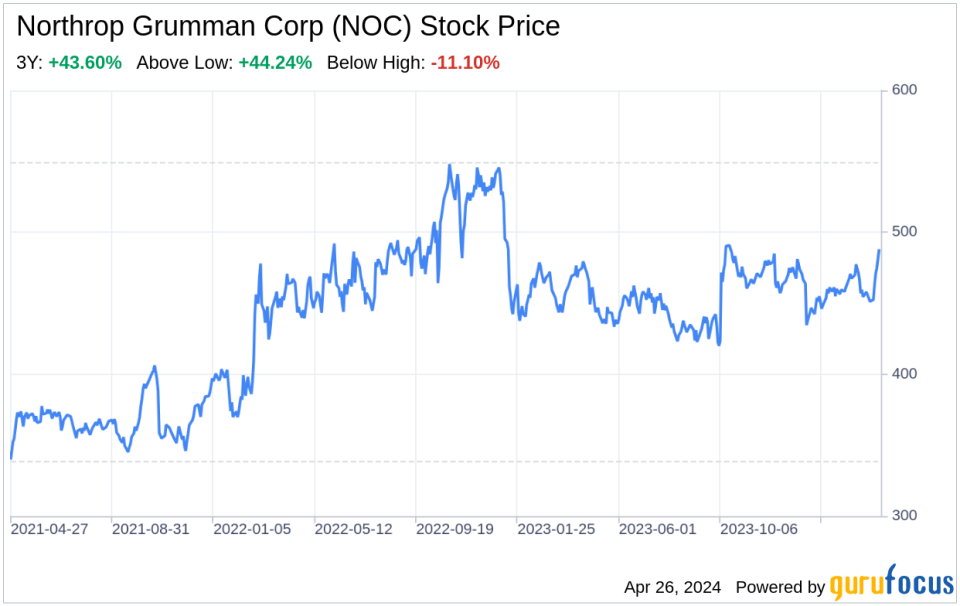

On April 25, 2024, Northrop Grumman Corp (NYSE:NOC), a leading global aerospace and defense technology company, disclosed its latest SEC 10-Q filing, revealing a comprehensive financial performance for the first quarter of the year. The company has demonstrated a robust financial position with total sales reaching $10,133 million, an 8.9% increase from the previous year's $9,301 million. This growth is attributed to a surge in product sales, which climbed by 11.4% to $8,102 million. Operating income also saw a notable rise to $1,071 million, up from $947 million, showcasing the company's operational efficiency. Net earnings have improved, standing at $944 million, with basic and diluted earnings per share escalating to $6.34 and $6.32, respectively. This financial overview sets the stage for a deeper SWOT analysis of Northrop Grumman Corp, providing investors with insights into the company's strategic positioning and future prospects.

Strengths

Market Leadership and Innovation: Northrop Grumman Corp (NYSE:NOC) stands as a paragon of innovation and market leadership in the aerospace and defense industry. The company's pioneering aerospace segment, including the F-35 fuselage and the B-21 bomber, underscores its commitment to cutting-edge technology and defense excellence. The recent financial filings reveal a solid increase in product sales, particularly in the Aeronautics Systems sector, which is a testament to the company's strong market position and the trust placed in its products by the U.S. Department of Defense and international customers.

Financial Robustness: The financial muscle of Northrop Grumman Corp (NYSE:NOC) is evident in its impressive sales growth and operational income. The company's balance sheet strength is further highlighted by a significant backlog of $78.9 billion, despite a $1.6 billion reduction due to a termination in the restricted Space business. This backlog not only reflects the company's ability to secure large contracts but also ensures a steady stream of future revenue, solidifying its financial stability.

Weaknesses

Dependence on Government Contracts: Northrop Grumman Corp's (NYSE:NOC) reliance on government contracts, particularly from the U.S. Department of Defense, could be a double-edged sword. While these contracts provide a stable revenue source, any shifts in government spending or policy changes could impact the company's financial performance. The recent termination in the restricted Space business, which led to a reduction in the backlog, serves as a reminder of the inherent risks associated with dependence on government contracts.

Operational Risks: The complexity of Northrop Grumman Corp's (NYSE:NOC) operations, involving cutting-edge technology and defense systems, carries operational risks. Any delays or cost overruns in key programs like the F-35 or B-21 could affect the company's profitability and reputation. Moreover, the company's service costs have remained consistent, indicating a need for improved efficiency in service operations to enhance margins.

Opportunities

Global Security Environment: The current global security environment, characterized by heightened tensions and instability, presents significant opportunities for Northrop Grumman Corp (NYSE:NOC). The company's advanced capabilities in space systems, missile defense, and advanced weapons position it to meet the increasing demand for defense products and services, both in the U.S. and internationally. This is particularly relevant given the ongoing conflicts and the need for robust defense capabilities.

Technological Advancements: Northrop Grumman Corp (NYSE:NOC) is well-positioned to leverage its investments in artificial intelligence, advanced computing, and cyber technologies. As these technologies become increasingly integral to national defense strategies, the company's expertise and innovative solutions could drive growth and open new markets, further expanding its customer base and revenue streams.

Threats

Competitive Landscape: The defense industry is highly competitive, with several major players vying for government contracts and technological leadership. Northrop Grumman Corp (NYSE:NOC) must continuously innovate and maintain operational excellence to stay ahead of competitors like Lockheed Martin and Boeing. Any loss of competitive edge could result in reduced market share and impact the company's financial performance.

Economic and Political Uncertainties: Macroeconomic factors such as inflation, supply chain disruptions, and workforce challenges pose threats to Northrop Grumman Corp's (NYSE:NOC) operational efficiency and cost structure. Additionally, political uncertainties and changes in defense spending priorities could affect the company's contract awards and revenue. The company must navigate these uncertainties adeptly to sustain its growth trajectory.

In conclusion, Northrop Grumman Corp (NYSE:NOC) exhibits a strong financial and strategic position, with robust sales growth, a significant backlog, and a commitment to innovation that aligns with current global security needs. However, the company must address its reliance on government contracts and operational risks while capitalizing on opportunities presented by the global security environment and technological advancements. The competitive landscape and economic and political uncertainties remain threats that require strategic management. Overall, Northrop Grumman Corp is well-equipped to navigate the challenges and leverage its strengths to maintain its status as a leader in the aerospace and defense industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.