3 Ways to Grow $100,000 Into $1 Million for Retirement Savings

Retiring comfortably doesn't happen by accident. It often takes years of dedicated work and savings. Fortunately, our friend, compounding, is there to help us out. Most wealthy people invest their money to grow it instead of stuffing every dollar into a savings account.

If you surveyed 100 millionaires, you'd probably meet very few who got that way without investing in something that appreciated in value over the years.

Growing from $100,000 to $1 million can seem daunting -- a tenfold increase. Don't fret; it's not as complicated as it looks.

Here are three ways to get the job done in time for retirement.

1. Ride the S&P 500

The simplest method of building wealth is to invest in the American economy. The S&P 500 is an index of 500 prominent American companies, often representing the best businesses the United States has to offer. The good thing about the S&P 500 is that using it to build wealth is a very straightforward idea: buy and hold.

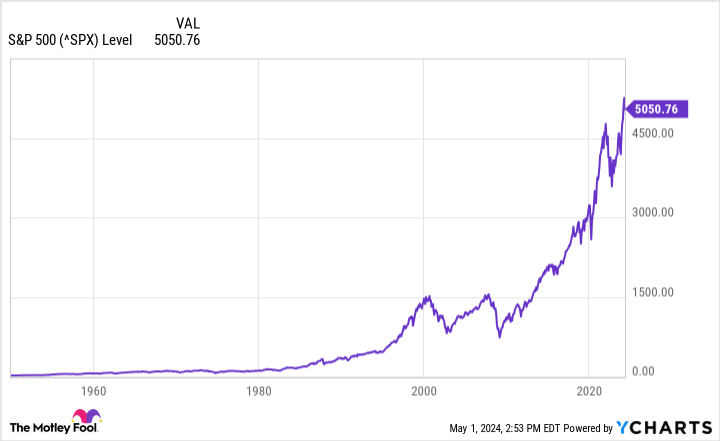

Stocks can be volatile from week to week and even year to year. But the stock market has always risen to new highs if you give it long enough:

The S&P 500 has a historical annualized return of about 10% over time, meaning investors can expect an investment to double every seven years on average. Buy a low-cost index fund that tracks the S&P 500; your $100,000 could grow to $1 million in about 23 years. You'll get there even faster by investing additional funds. Add $500 monthly and reach $1 million in just 19 years.

Of course, past results don't guarantee future outcomes, but history is on investors' side. If the U.S. stock market were permanently wiped out, you would probably have bigger problems than your portfolio.

2. Invest in blue chip stocks

Some people want to take a more hands-on approach to their investments and pick individual stocks to own. There's nothing wrong with that, especially if you enjoy learning and studying what you own. But your retirement nest egg is not the money to bet on the hot stock tip you heard at the bar.

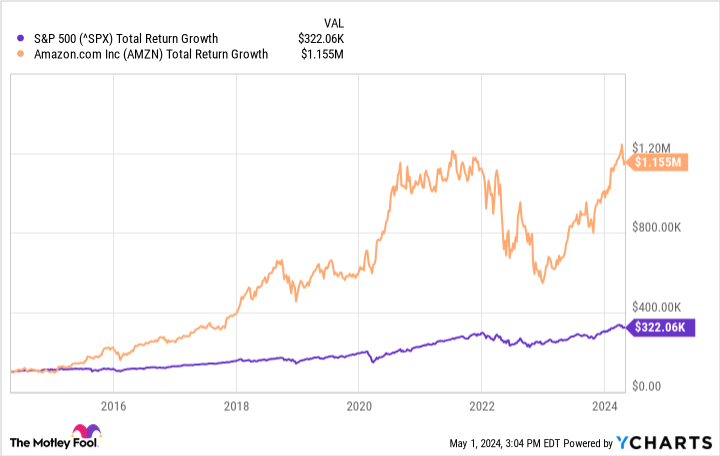

Instead, set yourself up for success by investing in a diversified portfolio of blue chip stocks. These are the household names that everyone knows. Think Amazon, Visa, etc.

Pick the right stock, like an Amazon, and you could reach your goals much faster:

Just remember that individual stocks carry more risk than the broader market, and even household names can be poor investments if the business isn't fundamentally sound.

Diversify, think long-term, and stay informed about your stocks; a blue-chip portfolio could be very kind to your retirement efforts.

3. Own real estate

Property is society's oldest form of wealth, and real estate is still a great way to make money today. There are more options than ever to get investment exposure to real estate, which can provide both passive income and capital appreciation if the property's value increases.

Investors can own property outright or buy shares of real estate investment trusts (REITs), publicly traded companies that lease property and distribute profits to shareholders. Owning property outright can have complicated tax implications, so ensure you're adequately informed and don't hesitate to consult a tax professional. Being a landlord can also be stressful and hard work sometimes, so it's not for everyone.

REITs are a great alternative that can easily be included in a broader stock portfolio. However, not every REIT is created equal, so check a company's track record and credit rating to gauge how well management operates the business.

There's no wrong answer

The cool part about building wealth is that there are no wrong answers as long as your money is working for you. People have different skills and backgrounds, so one person might feel more comfortable owning real estate. At the same time, others don't want to closely monitor their investments and are better off owning index funds.

You might dabble in all three, creating even more diversification across your nest egg.

There are no secret tricks to growing your money. It's about following a proven plan that suits your style. Take action, and you'll be surprised by how much money you can retire with.

What stocks should you add to your retirement portfolio?

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Visa. The Motley Fool has a disclosure policy.

3 Ways to Grow $100,000 Into $1 Million for Retirement Savings was originally published by The Motley Fool