Freshpet Inc (FRPT) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

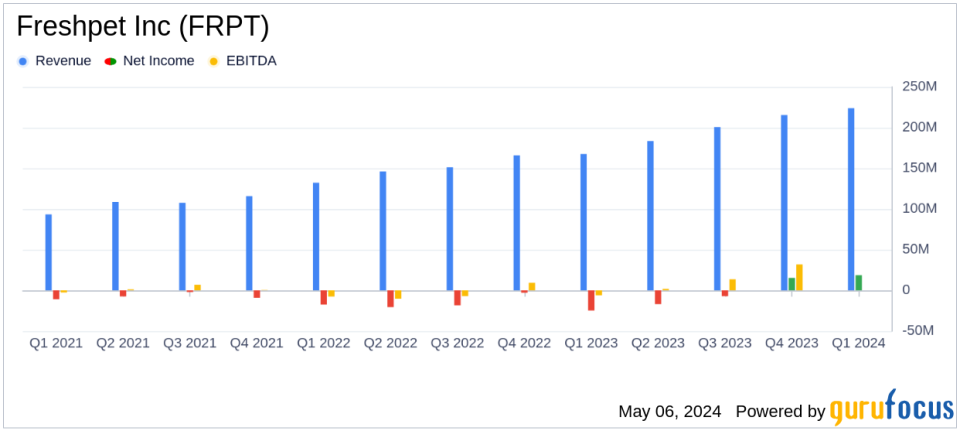

Revenue: Reached $223.8 million, marking a 33.6% increase year-over-year, surpassing the estimated $216.42 million.

Net Income: Improved to $18.6 million, a significant recovery from a net loss of $24.8 million in the prior year, **falling below** the estimated net loss of $11.57 million.

Earnings Per Share (EPS): Reported at $0.38 per share, a reversal from the previous year's loss of $0.52 per share, significantly **above** the estimated EPS of -$0.24.

Gross Margin: Increased to 39.4% from 30.3% last year, with adjusted gross margin rising to 45.3% from 38.5%.

Operating Cash Flow: Generated $5.4 million in cash from operations, a substantial improvement from a cash use of $13.74 million in the prior year period.

Adjusted EBITDA: Grew to $30.6 million from $3.0 million in the prior year, reflecting strong operational improvements and cost management.

Guidance: Company raises its full-year Adjusted EBITDA outlook, reflecting confidence in continued operational efficiency and sales growth.

Freshpet Inc (NASDAQ:FRPT) released its 8-K filing on May 6, 2024, revealing a significant surge in Q1 2024 earnings that exceeded analyst expectations in terms of revenue. The company reported a 33.6% increase in net sales, reaching $223.8 million, surpassing the estimated $216.42 million. This growth was primarily driven by a 30.6% increase in volume.

Freshpet, known for its premium fresh pet food products, continues to expand its market presence through company-owned refrigerators in various retail settings, predominantly in grocery stores which are pivotal to its distribution strategy. The company's focus remains on the U.S. market, contributing 96% to its sales, with a minor portion coming from international markets like Canada and the UK.

Financial Highlights and Operational Efficiency

The company's financial health showed remarkable improvement with a gross margin of 39.4%, a significant rise from 30.3% in the previous year. Adjusted gross margin also saw an increase to 45.3% from 38.5%. This improvement in profitability was attributed to better leverage on plant expenses, reduced quality costs, and lower input costs as a percentage of sales.

Net income stood at $18.6 million, a stark contrast to the net loss of $24.8 million reported in the same period last year. This turnaround was supported by the higher sales volume, enhanced gross margins, and a $9.9 million gain on equity investment. Selling, general and administrative expenses (SG&A) as a percentage of net sales decreased significantly to 35.6% from 43.1% due to reduced logistics costs and lower share-based compensation.

Balance Sheet and Cash Flow

As of March 31, 2024, Freshpet reported having $257.9 million in cash and cash equivalents, with a net debt position of $393.6 million after accounting for unamortized debt issuance costs. The company generated $5.4 million in cash from operations, reflecting an improvement of $19.1 million compared to the prior year period.

Strategic Outlook and Management Commentary

CEO Billy Cyr expressed confidence in the company's trajectory, emphasizing the robustness of the Freshpet business model and the operational improvements that have started to yield margin expansions. The company has updated its 2024 guidance, expecting continued growth and profitability improvements.

"Our strong first quarter results provide solid evidence that we can deliver our long-term financial goals and we are now determined to prove that we can achieve this level of performance consistently over time," stated Cyr.

Investor and Analyst Perspectives

The positive earnings report and the upward revision of the financial outlook for 2024 suggest that Freshpet is on a path to sustained growth and profitability, potentially offering an attractive proposition for investors. The company's focus on operational efficiency and market expansion are pivotal in driving its financial performance forward.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and listen to the earnings call available through the Freshpet website.

To learn more about Freshpet's strategic initiatives and financial performance, visit www.freshpet.com.

Explore the complete 8-K earnings release (here) from Freshpet Inc for further details.

This article first appeared on GuruFocus.