Boise Cascade Co (BCC) Surpasses Analyst Revenue Forecasts in Q1 2024

Net Income: $104.1M, an increase of 8% from $96.7M in Q1 2023, surpassing the estimate of $91.04M.

Earnings Per Share (EPS): $2.61, up from $2.43 in Q1 2023, exceeding the estimate of $2.30.

Revenue: $1.645 billion, a 7% increase from $1.544 billion in Q1 2023, slightly above the estimate of $1.563 billion.

Wood Products Sales: Increased by 7% to $468.9M, driven by higher sales volumes for I-joists and LVL, and higher plywood sales prices.

Building Materials Distribution Sales: Rose by 9% to $1.505 billion, with a notable increase in sales volumes across product lines.

Dividend: Declared a quarterly dividend of $0.20 per share, payable on June 17, 2024.

Liquidity: Ended the quarter with $890.2M in cash and cash equivalents, with total available liquidity of $1.286 billion.

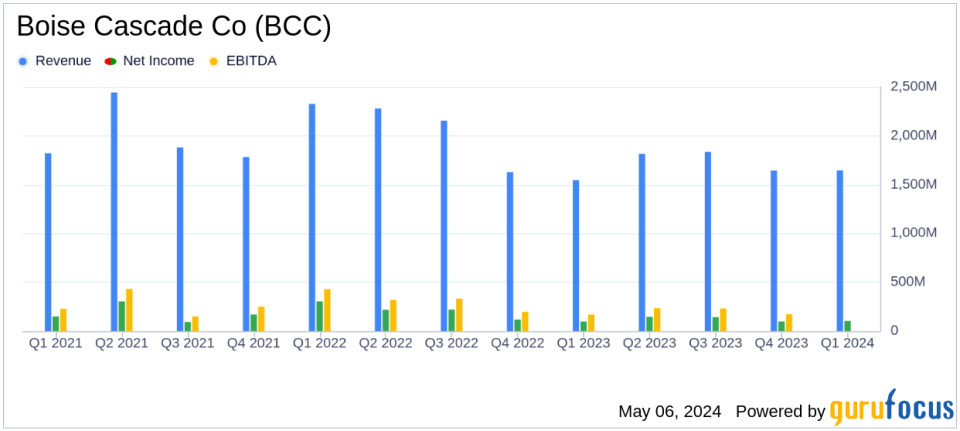

Boise Cascade Co (NYSE:BCC) released its 8-K filing on May 6, 2024, reporting a robust financial performance for the first quarter of 2024. The company announced a net income of $104.1 million, or $2.61 per share, on sales of $1.6 billion for the quarter ended March 31, 2024. These results compare favorably to the first quarter of 2023, which saw a net income of $96.7 million, or $2.43 per share, on sales of $1.5 billion. Notably, the reported revenue and earnings per share (EPS) exceeded analyst expectations, which estimated earnings of $2.30 per share on revenue of $1563.42 million.

Boise Cascade Co, a leading producer of engineered wood products and plywood, operates primarily through two segments: Wood Products and Building Materials Distribution. The Wood Products segment saw sales increase by 7% to $468.9 million, driven by higher sales volumes for I-joists and LVL, as well as higher plywood sales prices. The Building Materials Distribution segment reported a 9% increase in sales, reaching $1.505 billion, attributed to a 12% increase in sales volume offset by a 3% decrease in sales prices.

Financial Highlights and Sector Performance

The company's EBITDA for the quarter stood at $168.5 million, marking a 6% increase from the previous year's $158.7 million. This growth reflects the company's effective cost management and robust sales performance. Segment-wise, the Wood Products sector notched an income of $71.2 million, up from $69.4 million in Q1 2023, while the Building Materials Distribution sector recorded an income of $72.5 million, up from $69.7 million.

Strategic Financial Management

Boise Cascade ended the first quarter with a strong balance sheet, boasting $890.2 million in cash and cash equivalents and $395.7 million of undrawn committed bank line availability, totaling $1.286 billion in available liquidity. The company's proactive capital management is evident in its capital expenditure forecast for 2024, projected at $250 million to $270 million, excluding potential acquisition spending. Additionally, the board declared a quarterly dividend of $0.20 per share, payable on June 17, 2024, demonstrating its commitment to shareholder returns.

Market Outlook and Forward Strategy

Looking ahead, Boise Cascade anticipates that demand for its products will continue to be driven by new residential construction, residential repair-and-remodeling activity, and light commercial construction. Despite challenges such as home affordability and economic uncertainties, the company remains optimistic about the housing market, supported by low unemployment and an undersupply of existing housing stock.

CEO Nate Jorgensen expressed confidence in the company's strategy and market position, stating,

As we enter the second quarter, economic and geopolitical uncertainties are prevalent, and the extent of the potential impact on the broader economy and residential construction activity is unknown. Despite the near-term environment, an undersupply of single-family homes remains, and I have great confidence in our team as we stay focused on the effective deployment of our outstanding balance sheet in support of our stakeholders."

Boise Cascade's first quarter performance sets a positive tone for 2024, underpinned by strong sales growth and strategic financial management. Investors and stakeholders can look forward to continued growth and operational efficiency as the company navigates the evolving market landscape.

Explore the complete 8-K earnings release (here) from Boise Cascade Co for further details.

This article first appeared on GuruFocus.