Noble Corp PLC (NE) Q1 2024 Earnings: Surpasses Revenue Forecasts, Meets EPS Expectations

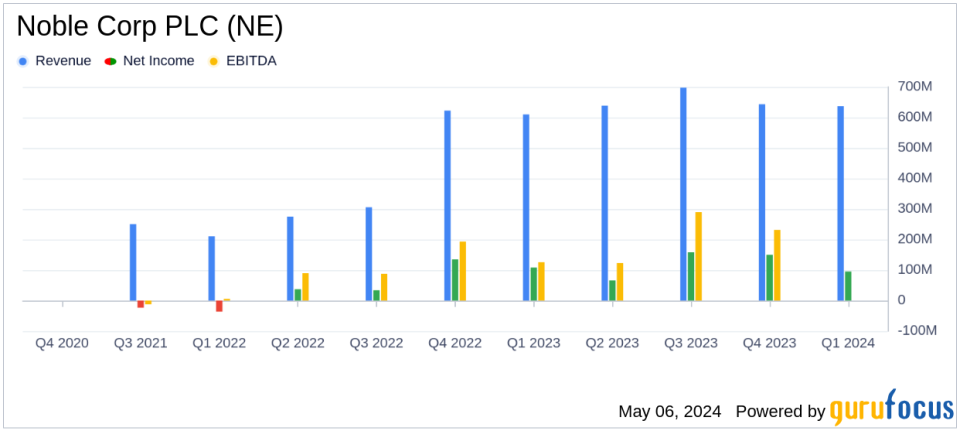

Net Income: Reported at $95 million, surpassing the estimated $71.14 million.

Earnings Per Share (EPS): Diluted EPS of $0.66, exceeding the estimate of $0.52.

Revenue: Total revenue reached $637 million, surpassing the estimated $591.87 million.

Free Cash Flow: Recorded at -$38 million, indicating a negative cash flow position for the quarter.

Adjusted EBITDA: Achieved $183 million, reflecting strong operational performance and a 32% year-over-year improvement.

Dividend: Announced an interim dividend of $0.40 per share, payable on June 27, 2024, emphasizing ongoing shareholder returns.

Future Outlook: Maintained full-year 2024 guidance with expected total revenue between $2,550 to $2,700 million and Adjusted EBITDA between $925 to $1,025 million.

Noble Corp PLC (NYSE:NE) released its 8-K filing on May 6, 2024, detailing its financial results for the first quarter of 2024. The company reported a net income of $95 million and diluted earnings per share (EPS) of $0.66, aligning with analyst estimates for EPS but surpassing revenue expectations with a total revenue of $637 million against the forecasted $591.87 million.

Noble Corp PLC, a prominent offshore drilling contractor for the oil and gas industry, operates a high-specification fleet of both floating and jackup rigs. The company's services are crucial in exploring and extracting oil and gas from offshore fields globally.

Financial and Operational Highlights

The company's revenue for contract drilling services was $612 million, a slight increase from the previous quarter's $609 million, driven by improved utilization rates. The marketed fleet utilization rose to 72% in Q1 2024 from 68% in the last quarter of 2023. However, net income saw a decline from $150 million in Q4 2023 to $95 million in Q1 2024, and Adjusted EBITDA also decreased to $183 million from $201 million in the previous quarter.

Despite these challenges, Noble Corp maintained a strong balance sheet with a total debt principal of $600 million and cash reserves of $212 million as of March 31, 2024. The Board of Directors also approved a quarterly dividend of $0.40 per share, emphasizing the company's commitment to returning value to shareholders.

Strategic Developments and Market Outlook

Robert W. Eifler, President and CEO, highlighted the company's robust operational performance and the recovery in contracting momentum for high-spec rigs. He noted, "Our outlook for an earnings and cash flow inflection in the second half of this year is well supported by several meaningful contract startups that are on schedule to commence over the next several months."

Noble's backlog as of May 6, 2024, stands strong at $4.4 billion, with new contracts lined up that are expected to bolster the company's performance through 2025 and 2026. The company maintains its full-year 2024 guidance with total revenue expected to be between $2,550 million and $2,700 million and Adjusted EBITDA between $925 million and $1,025 million.

Investor Considerations

The first quarter results of Noble Corp PLC reflect a solid start to the year, navigating through a dynamic market environment. The company's ability to maintain a robust backlog and secure new contracts in a competitive sector underscores its operational and financial health. Investors and stakeholders can anticipate continued focus on high-spec assets and shareholder returns, positioning Noble well for future growth in the evolving energy landscape.

For detailed insights and further information, you can access the full earnings report and listen to the earnings call scheduled for May 7, 2024. This will provide a deeper dive into the company's strategy and outlook, directly from its leadership team.

Explore the complete 8-K earnings release (here) from Noble Corp PLC for further details.

This article first appeared on GuruFocus.