ThredUp Inc. (TDUP) Q1 2024 Earnings: Navigating Challenges with Strategic AI Investments

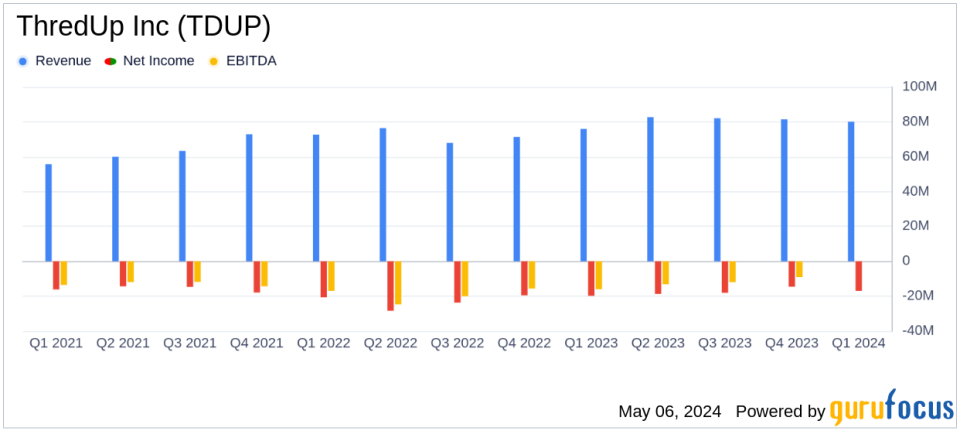

Revenue: Reported $79.6 million, up 5% year-over-year, falling short of estimates of $80.14 million.

Net Loss: Recorded at $16.6 million, an improvement from a net loss of $19.8 million year-over-year, but above the estimated net loss of $15.30 million.

Earnings Per Share: Reported a loss of $0.15 per share, worse than the estimated loss of $0.14 per share.

Gross Margin: Improved to 69.5% from 67.3% in the previous year, indicating a more profitable revenue mix.

Active Buyers and Orders: Increased to 1.7 million and 1.7 million respectively, showing a growth of 4% and 9% year-over-year.

Adjusted EBITDA: Loss reduced to $0.7 million from a loss of $6.6 million in the previous year, marking significant operational improvements.

Free Cash Flow: Positive outlook with an expectation of positive free cash flow on an annual basis, signaling improved financial health and operational efficiency.

On May 6, 2024, ThredUp Inc (NASDAQ:TDUP), a prominent online resale platform for women's and kids' apparel, released its 8-K filing, detailing its financial performance for the first quarter ended March 31, 2024. The company reported a revenue of $79.6 million, a 5% increase year-over-year but slightly below the analyst expectations of $80.14 million. The net loss improved to $16.6 million from $19.8 million in the prior year, showing significant progress in reducing losses.

Company Overview

ThredUp Inc operates as a major player in the online resale market, primarily in the United States. It offers a comprehensive platform for buying and selling secondhand apparel, shoes, and accessories, catering to eco-conscious consumers looking for value. The company's innovative approach includes a managed marketplace model supported by proprietary technology and a focus on sustainability.

Financial and Operational Highlights

The first quarter saw ThredUp achieving a gross margin of 69.5%, up from 67.3% in the previous year, reflecting more efficient operations and better inventory management. The gross profit rose by 8% to $55.3 million. Active buyers increased to 1.729 million, a 4% rise, while orders jumped by 9% to 1.651 million, indicating solid customer engagement.

Strategic Developments and Future Outlook

Under the leadership of CEO James Reinhart, ThredUp is transitioning towards an AI-driven operating model. This strategic pivot involves significant investment in AI technologies to enhance product offerings and operational efficiencies. The company has also streamlined its operations, reducing annual operating expenses by approximately $17 million and cutting its global corporate headcount by about 20%.

"We delivered another quarter of strong financial performance, demonstrating healthy gross profit growth and bottom-line leverage," said ThredUp CEO James Reinhart. "Looking ahead, we are focused on reshaping ThredUp into an AI-powered resale company by increasing investments in product, operations, and marketing, while reducing operating expenses and accelerating our path to free cash flow."

The company's forward-looking statements suggest a positive trajectory, with revenue projections for Q2 2024 ranging between $81.0 million and $83.0 million and an expected gross margin of 71.0% to 73.0%. For the full year, ThredUp anticipates revenue between $328.0 million and $338.0 million, aiming for a gross margin of 71.0% to 72.0% and an adjusted EBITDA margin of 2.0% to 4.0%.

Challenges and Industry Context

Despite the optimistic outlook, ThredUp faces challenges, including intense competition in the online resale market and the need to continuously innovate to attract and retain customers. The broader economic environment, characterized by inflationary pressures and potential shifts in consumer spending, could also impact performance.

Conclusion

ThredUp's first quarter of 2024 reflects a company in transition, leveraging technology to refine its business model while managing the typical challenges of the retail sector. With a clear focus on AI integration and operational efficiency, ThredUp is positioning itself to capitalize on the growing trend towards sustainable fashion and secondhand goods. Investors and stakeholders may find ThredUp's strategic adjustments and resilience in navigating market challenges to be of particular interest as they assess the company's potential for long-term growth.

For detailed financial metrics and further information, please refer to the full earnings report and supplementary materials available on ThredUps investor relations website.

Explore the complete 8-K earnings release (here) from ThredUp Inc for further details.

This article first appeared on GuruFocus.