CompoSecure Inc (CMPO) Surpasses Q1 Revenue Estimates with Record Sales, Announces Special Dividend

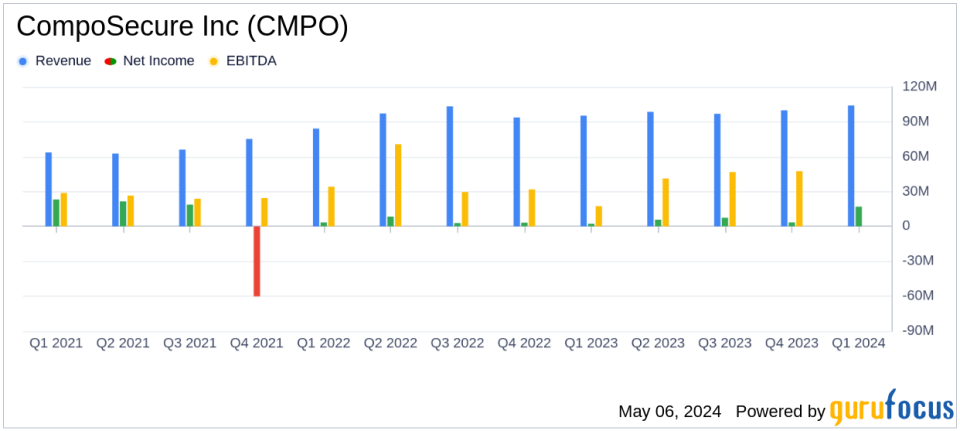

Revenue: Reached $104.0 million, up 9% year-over-year, surpassing estimates of $98.92 million.

Net Income: Increased by 59% to $17.1 million, below estimates of $22.67 million.

Earnings Per Share (EPS): Reported at $0.20 (Basic) and $0.17 (Diluted), compared to $0.13 (Basic) and $0.11 (Diluted) in the previous year.

Adjusted EBITDA: Rose 6% to $37.8 million, driven by higher net sales.

Gross Margin: Gross profit increased to $55.2 million or 53.1% of net sales, though the margin decreased from 56.0% due to inflationary pressures and product mix.

Special Cash Dividend: Declared a special cash dividend of $0.30 per share, reflecting strong free cash flow and robust cash position.

Liquidity and Debt: Ended the quarter with $55.1 million in cash and $335.6 million in total debt, improving from a cash position of $22.6 million and debt of $362.8 million the previous year.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On May 6, 2024, CompoSecure Inc (NASDAQ:CMPO), a leader in metal payment cards and security solutions, released its 8-K filing, revealing a record-setting first quarter for 2024. The company reported a significant 9% increase in net sales, reaching $104 million, and a 59% surge in net income to $17.1 million, both figures surpassing analyst expectations.

Founded in 2000, CompoSecure specializes in the design and manufacture of premium financial cards. The company's innovative metal payment card technology and Arculus security platform not only deliver premium branded experiences but also ensure trust and security in financial transactions.

Financial Performance and Strategic Dividends

The company's robust performance is highlighted by a growth in net sales driven primarily by its metal payment card business. Despite facing inflationary pressures which slightly reduced the gross margin to 53.1% from 56.0%, the company managed to increase its gross profit by 3% to $55.2 million.

Adjusted EBITDA saw a 6% increase to $37.8 million, reflecting the company's effective management and operational efficiency. CompoSecure's strong cash position, with a balance of $55 millionmore than double from the previous yearhas enabled it to declare a special cash dividend of $0.30 per share, underscoring its commitment to shareholder returns.

Operational Highlights and Future Outlook

CompoSecure reported several successful launches in the quarter, including high-profile customer programs like the limited edition Delta Reserve card made from a recycled airplane and the Robinhood Gold Card. These initiatives demonstrate the company's innovative approach and ability to capture market attention.

The company's liquidity has improved, with a decrease in total debt from $362.8 million in Q1 2023 to $335.6 million in Q1 2024, and a secured debt leverage ratio improvement from 1.60x to 1.34x. Looking ahead, CompoSecure reiterates its full-year guidance for 2024, projecting net sales between $408 million and $428 million and adjusted EBITDA between $147 million and $157 million.

Conclusion

CompoSecure's Q1 2024 results not only reflect a strong start to the year but also highlight the company's resilience and strategic foresight in managing operational challenges and capitalizing on market opportunities. The declaration of a special dividend further reflects the company's healthy financial standing and commitment to delivering value to its shareholders.

For more detailed information, investors and interested parties are encouraged to attend the upcoming conference call or access the live webcast available on the investor relations section of CompoSecures website.

Explore the complete 8-K earnings release (here) from CompoSecure Inc for further details.

This article first appeared on GuruFocus.