Tactile Systems Technology Inc (TCMD) Q1 2024 Earnings: Narrower Operating Loss and Revenue Growth

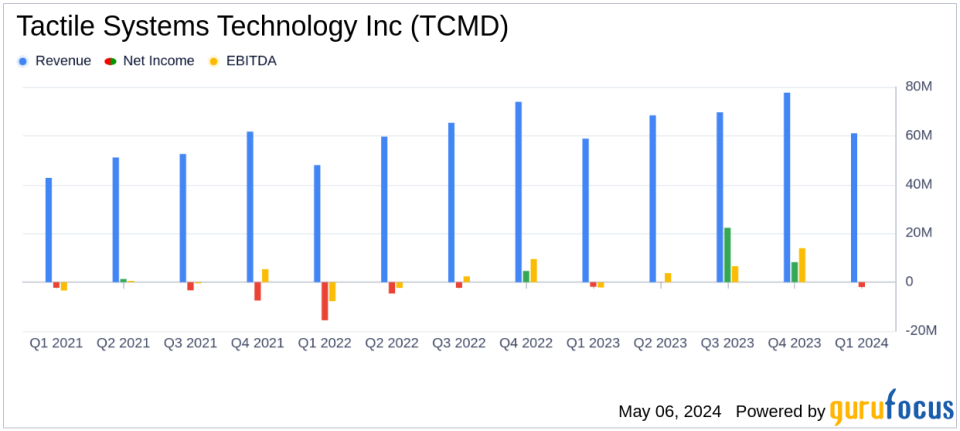

Revenue: Reported at $61.1 million for Q1 2024, up 4% year-over-year, exceeding estimates of $59.18 million.

Net Loss: Recorded at $2.2 million in Q1 2024, compared to a loss of $1.9 million in Q1 2023, wider than the estimated loss of $1.66 million.

Earnings Per Share (EPS): Reported at -$0.09, better than the estimated -$0.11.

Gross Margin: Improved to 71.1% in Q1 2024 from 70.5% in Q1 2023.

Operating Expenses: Increased by 2% to $46.4 million in Q1 2024 from $45.3 million in the previous year.

Adjusted EBITDA: Increased to $1.0 million in Q1 2024 from $0.5 million in Q1 2023.

2024 Financial Outlook: Reaffirms full-year revenue guidance of $300 million to $305 million, indicating a growth of 9% to 11% year-over-year.

Tactile Systems Technology Inc (NASDAQ:TCMD) released its 8-K filing on May 6, 2024, detailing the financial outcomes for the first quarter ended March 31, 2024. The company reported a revenue of $61.1 million, surpassing the analyst estimate of $59.18 million, and a net loss of $2.2 million or ($0.09) per diluted share, slightly better than the estimated loss of $1.66 million or ($0.11) per share.

Tactile Systems Technology Inc, a leading medical technology firm, specializes in developing innovative medical devices for the treatment of chronic diseases at home. The company's flagship products include the Flexitouch system for lymphedema and the AffloVest for airway clearance.

Quarterly Financial Highlights

The first quarter saw a 4% increase in total revenue year-over-year, driven by a 5% growth in lymphedema product sales, which offset a 4% decline in airway clearance product revenue. Gross profit rose by 5% to $43.4 million, with a gross margin improvement from 70.5% to 71.1%. Despite these gains, the company reported an operating loss of $3.0 million, an improvement from a loss of $3.8 million in the prior year's quarter.

Strategic Initiatives and Market Position

President and CEO Dan Reuvers highlighted the company's focus on operational efficiency and technological advancements to sustain growth.

We were pleased with our overall first quarter performance... We remain focused on driving improved operating efficiencies while advancing key tech-related investments,"

said Reuvers.

Financial Position and Outlook

As of March 31, 2024, Tactile Systems reported $60.7 million in cash and cash equivalents. The company reaffirmed its full-year 2024 revenue guidance, expecting it to be between $300 million and $305 million, indicating a 9% to 11% growth from the previous year.

Analysis of Performance

The company's ability to exceed revenue expectations while narrowing its operating loss reflects effective cost management and robust demand for its lymphedema products. The slight improvement in gross margin underscores the company's ongoing efforts to enhance profitability through operational efficiencies.

The financial stability of Tactile Systems, coupled with its strategic focus on expanding its product offerings and improving operational efficiencies, positions it well for sustainable growth. However, the continued investment in technology and potential market fluctuations could impact future performance.

For detailed financial figures and future projections, interested parties can access the full earnings call and additional documents through the investor relations section of Tactile Systems' website.

Explore the complete 8-K earnings release (here) from Tactile Systems Technology Inc for further details.

This article first appeared on GuruFocus.