Assertio Holdings Inc (ASRT) Surpasses Revenue Estimates But Reports Wider Loss in Q1 2024

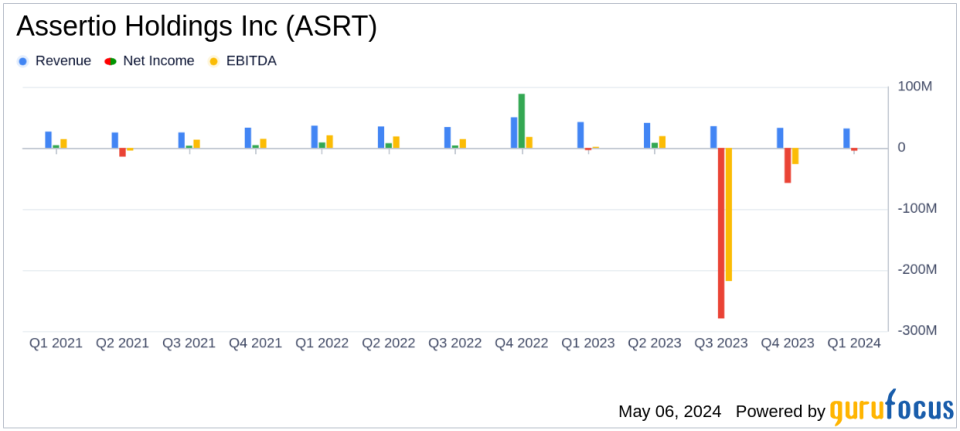

Revenue: Reported $31.9 million in net product sales for Q1 2024, exceeding estimates of $29.51 million.

Net Loss: Recorded a net loss of $4.5 million, exceeding the estimated net loss of $2.93 million.

Earnings Per Share (EPS): Reported a loss per share of $0.05, above the estimated loss per share of $0.03.

Cash Flow: Generated $7.5 million in cash flow from operations, increasing cash reserves to $80.7 million.

Adjusted EBITDA: Achieved $7.4 million, showing an improvement from $4.5 million in the previous quarter.

Rolvedon Sales: Rolvedon net product sales grew to $14.5 million, marking continuous demand growth since its launch.

Financial Guidance: Reiterated 2024 guidance with net product sales expected between $110 million and $125 million, and adjusted EBITDA forecasted at $20 million to $30 million.

On May 6, 2024, Assertio Holdings Inc (NASDAQ:ASRT) released its 8-K filing, disclosing the financial outcomes for the first quarter ended March 31, 2024. The pharmaceutical company, known for its neurology, orphan, and specialty medicines, reported a net product sales of $31.9 million, surpassing the analyst's estimate of $29.51 million. However, the company's net loss widened to $4.5 million, or $0.05 per share, missing the estimated loss of $2.93 million, or $0.03 per share.

Company Overview

Assertio Holdings Inc is a pharmaceutical entity engaged in delivering differentiated products that enhance patient care in neurology and other specialized areas. The company markets three FDA-approved products, including Gralise, CAMBIA, and Zipsor, which address various neurological conditions.

Financial Performance Analysis

The reported quarter saw Assertio achieving several financial milestones despite facing challenges such as generic competition impacting its product Indocin, which saw a decrease in net sales to $8.7 million from $10.8 million in the previous quarter. The standout performer was Rolvedon, generating $14.5 million in net product sales, marking its fifth consecutive quarter of growth. This growth was primarily driven by increased market penetration in clinical settings.

Assertio's gross margin stood at 65%, with an adjusted figure of 78% when excluding amortization impacts. This slight decrease from the previous quarter's 79% reflects the competitive pressures and cost dynamics the company navigates in the pharmaceutical industry.

Operating expenses showed a positive trend, with selling, general, and administrative costs reducing to $18.5 million from $24.0 million in the previous quarter, highlighting effective cost management strategies. This reduction contributed to an improved adjusted EBITDA of $7.4 million, up from $4.5 million, showcasing enhanced operational efficiency.

Strategic Developments and Future Outlook

Assertio's interim CEO, Heather Mason, emphasized the company's commitment to growth through strategic asset acquisitions and operational excellence. The successful enrollment for Rolvedon's same-day dosing trial, with results expected by year-end, could further enhance its market differentiation. Assertio has reiterated its 2024 guidance, projecting net product sales between $110 million to $125 million and adjusted EBITDA of $20 million to $30 million.

Balance Sheet and Cash Flow Insights

The company strengthened its financial position with $80.7 million in cash and cash equivalents, supported by $7.5 million generated from operations. This financial stability is crucial as Assertio navigates through its strategic initiatives and potential market challenges.

Investor and Market Implications

While Assertio's revenue outperformance signifies robust product demand, the widened net loss could concern investors looking for profitability. However, the company's strategic maneuvers, including cost control and product development, might build investor confidence in its long-term growth trajectory. Assertio's ability to manage generic competition and innovate in its product offerings will be critical in sustaining and enhancing shareholder value.

For more detailed financial figures and future updates, investors and interested parties are encouraged to access the full earnings report and follow upcoming investor presentations linked on Assertio's investor relations page.

Explore the complete 8-K earnings release (here) from Assertio Holdings Inc for further details.

This article first appeared on GuruFocus.