The Aarons Co Inc (AAN) Q1 2024 Earnings: Misses Revenue and Earnings Expectations

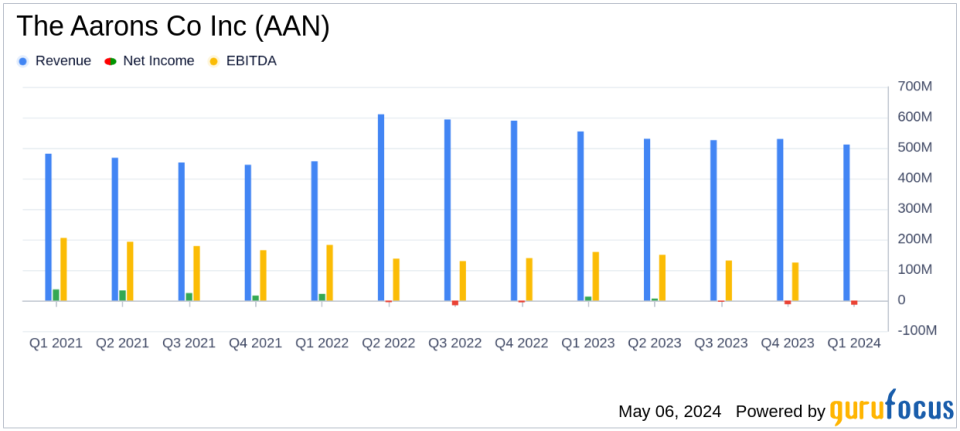

Revenue: Reported at $511.5 million, falling short of the estimated $516.66 million.

Net Loss: Posted a net loss of $14.2 million, significantly higher than the estimated net income of -$3.07 million.

Earnings Per Share (EPS): Recorded a loss per share of $0.46, underperforming against the estimated EPS of -$0.07.

Adjusted EBITDA: Achieved $22.7 million, indicating a substantial decline from the previous year's $45.9 million.

Same-Store Sales: Same store lease portfolio size decreased by 1.4% year-over-year, showing a slight improvement sequentially.

E-commerce Growth: E-commerce recurring revenue surged by 94.1%, driven by new omnichannel lease decisioning and customer acquisition program.

Dividend: Announced a quarterly cash dividend of $0.125 per share, payable on July 3, 2024.

The Aarons Co Inc (NYSE:AAN) disclosed its first quarter 2024 financial outcomes on May 6, 2024, revealing a challenging quarter with revenues and earnings falling short of analyst expectations. The company reported a revenue of $511.5 million against an estimated $516.66 million and a loss per share of $0.46, significantly below the estimated loss per share of $0.07. For a comprehensive view, the details can be accessed through their 8-K filing.

About The Aarons Co Inc

Headquartered in Atlanta, The Aarons Co Inc operates a specialty retail business model focusing on lease-to-own and retail purchase solutions of high-quality appliances, electronics, furniture, and other home goods. It serves a significant portion of the U.S. population through its Aaron's Business and BrandsMart segments, offering services both in-store and online.

Quarterly Performance Insights

The first quarter saw AAN grappling with several challenges, including a decrease in lease portfolio sizes and comparable sales at BrandsMart, which fell by 9.4%. However, there were some positive developments such as a 94.1% increase in e-commerce recurring revenue and an 18.6% increase in lease merchandise deliveries in April, driven by a new omnichannel lease decisioning and customer acquisition program.

Financial Health and Achievements

The company's adjusted EBITDA stood at $22.7 million, a stark contrast to the previous year, reflecting the operational and market challenges. Despite these hurdles, AAN remains committed to its strategic priorities, including enhancing operational performance and innovating its business model to better serve customers. Notably, the company announced a quarterly cash dividend of $0.125 per share, underscoring its commitment to shareholder returns even in tough times.

Management Commentary

"We are seeing strong positive momentum in the business, and our first quarter results were in line with our guidance. Our new omnichannel lease decisioning and customer acquisition program at the Aarons Business is driving significant growth in lease merchandise deliveries, and we continue to expect mid-single digit lease portfolio growth by the end of 2024," stated Douglas Lindsay, CEO of The Aarons Co Inc.

Future Outlook

Looking ahead, The Aarons Co Inc reaffirmed its full-year 2024 revenue and adjusted EBITDA outlook but raised its non-GAAP EPS outlook, reflecting a lower estimated tax rate. The company anticipates revenues to be between $2.055 billion and $2.155 billion with an adjusted EBITDA between $105.0 million and $125.0 million, and a non-GAAP diluted EPS ranging from $0.00 to $0.25.

As AAN navigates through these turbulent times, the focus remains on strategic initiatives aimed at operational efficiency and market adaptation. Investors and stakeholders are advised to monitor these developments closely, as they will play a crucial role in the company's performance in the upcoming quarters.

For further details, The Aarons Co Inc will host an earnings conference call on May 7, 2024, providing an opportunity for deeper insights into its strategies and expectations for the future.

Explore the complete 8-K earnings release (here) from The Aarons Co Inc for further details.

This article first appeared on GuruFocus.