Gladstone Commercial Corp (GOOD) Q1 2024 Earnings: Meets EPS Estimates, Revenue Slightly Down

Revenue: Reported at $35.72 million for Q1 2024, slightly below estimates of $36.29 million.

Net Income: Achieved $3.53 million, significantly above the estimated loss of $0.20 million.

Earnings Per Share (EPS): Basic and diluted EPS stood at $0.01, aligning with the quarterly estimate.

Funds from Operations (FFO): Basic and diluted FFO per share were $0.34, reflecting a decrease from the previous quarter's $0.36.

Core Funds from Operations (Core FFO): Basic and diluted Core FFO per share also recorded at $0.34, indicating a slight decline from the prior quarter.

Asset Management: Sold three non-core properties for $19.5 million as part of the capital recycling program and repaid $17.7 million in mortgage debt.

Occupancy Rates: Maintained high occupancy with 98.9% of square feet leased as of Q1 2024.

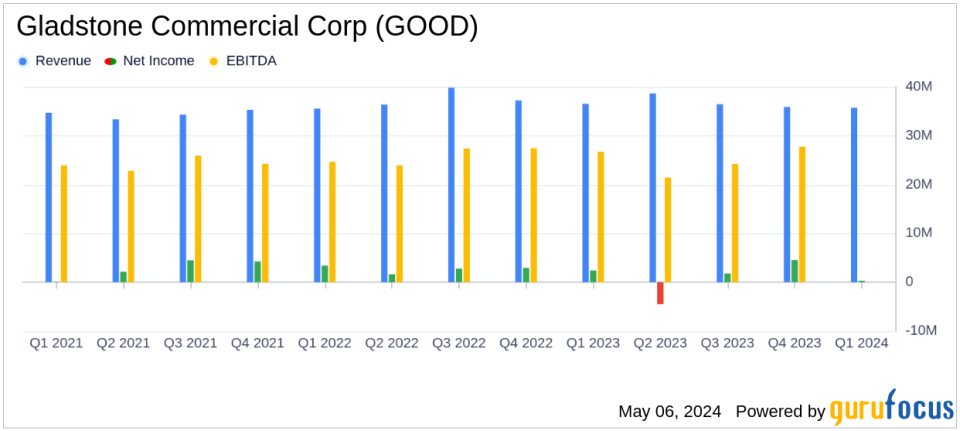

Gladstone Commercial Corp (NASDAQ:GOOD) released its 8-K filing on May 6, 2024, detailing its financial results for the first quarter ended March 31, 2024. The real estate investment trust (REIT), known for its investments in net leased industrial, commercial, and retail real property, reported earnings that aligned with analyst estimates on earnings per share but saw a slight decline in revenue compared to the previous quarter.

Financial Overview

For Q1 2024, Gladstone Commercial posted total operating revenue of $35.72 million, a minor decrease from $35.91 million in the preceding quarter, reflecting a 0.5% dip. This figure slightly missed the analyst's expectation of $36.29 million. Net income stood at $3.53 million, down 22.5% from $4.55 million in Q4 2023. After adjusting for dividends on preferred and senior common stock, net income available to common stockholders and Non-controlling OP Unitholders was $306,000, translating to $0.01 per share, consistent with analyst projections.

The company's Funds from Operations (FFO) and Core FFO, both crucial metrics for REITs, were reported at $13.54 million and $13.84 million respectively, marking a decrease from the previous quarter's figures. This decline was primarily attributed to higher property expenses and a one-time incentive fee.

Operational Highlights

Gladstone Commercial's operational strategies in the quarter included the sale of three non-core properties, which is part of its capital recycling program, and the repayment of $17.7 million in fixed-rate mortgage debt. The company also successfully issued Series F Preferred Stock, raising net proceeds of $0.2 million. Importantly, the REIT maintained a 100% cash rent collection rate during the quarter, underscoring strong operational execution amid economic uncertainties.

Strategic Initiatives and Market Positioning

According to Buzz Cooper, President of Gladstone Commercial, the company is focused on selling non-core assets to de-lever its portfolio and reinvest in target growth markets, particularly in industrial properties. Despite challenges such as significant inflation and rising interest rates, the company's robust tenant credit underwriting has helped maintain financial stability. The REIT has also amended its credit facility to increase financial flexibility, which is critical in the current economic climate.

Future Outlook and Investor Relations

Looking ahead, Gladstone Commercial remains committed to its strategy of asset management and targeted investments. The company has declared monthly cash distributions for the upcoming quarter and continues to actively market its vacant spaces. With a conference call scheduled for May 7, 2024, the company will likely provide further insights into its strategies and outlook.

Investors and stakeholders can access more detailed financial information and future updates through the investors section of Gladstone Commercial's website.

Conclusion

Gladstone Commercial Corp's first-quarter results reflect a cautious yet strategic approach to navigating the complex real estate market. By aligning closely with analyst expectations on EPS and maintaining solid operational performance, the company is positioning itself to leverage opportunities in its targeted growth sectors despite broader economic pressures.

Explore the complete 8-K earnings release (here) from Gladstone Commercial Corp for further details.

This article first appeared on GuruFocus.