Zeta Global Holdings Corp (ZETA) Surpasses Q1 Revenue Estimates and Raises 2024 Guidance

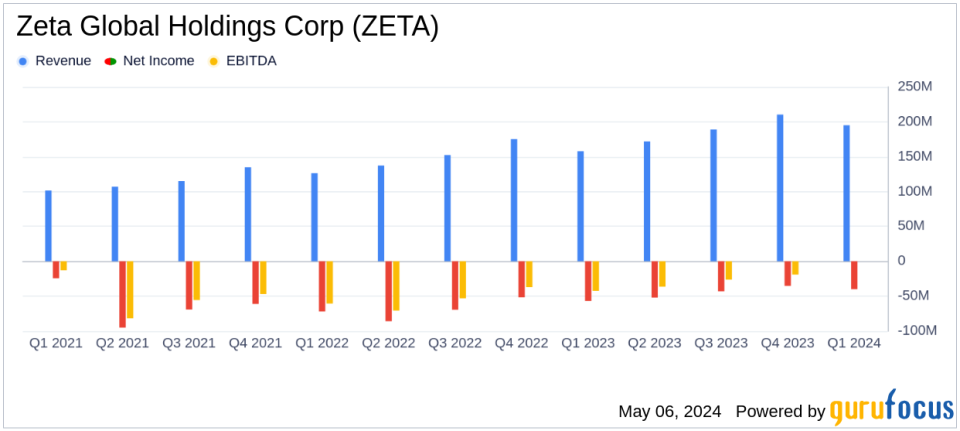

Revenue: $195M, up 24% year-over-year, surpassing estimates of $187.11M.

Net Loss: Reported a net loss of $39.57M, an improvement from a net loss of $56.95M year-over-year.

Earnings Per Share (EPS): Reported a loss per share of $0.23, an improvement from a loss per share of $0.38 in the same quarter last year.

Free Cash Flow: Increased to $15M, up 51% year-over-year, indicating stronger financial health.

Operating Cash Flow: Grew to $25M, reflecting a 23% increase year-over-year, demonstrating enhanced operational efficiency.

Customer Growth: Scaled Customer count rose to 460, up from 411 year-over-year, and Super Scaled Customer count increased to 144 from 110 year-over-year.

Guidance: Raised full-year revenue guidance to $895M-$905M, signaling confidence in continued growth.

Zeta Global Holdings Corp (NYSE:ZETA) released its 8-K filing on May 6, 2024, revealing a robust start to the year with first-quarter revenues and earnings that exceeded analyst expectations. The company reported a significant year-over-year revenue increase and has raised its financial outlook for the remainder of 2024, reflecting strong confidence in its growth trajectory.

About Zeta Global Holdings Corp

Zeta Global Holdings Corp is a leading provider of omnichannel data-driven cloud solutions, offering enterprises advanced consumer intelligence and marketing automation software. The Zeta Marketing Platform (ZMP) integrates sophisticated machine learning algorithms and a vast data set to predict consumer intent, supporting businesses across various sectors like financial services, insurance, and retail in enhancing their marketing efficacy.

First Quarter Financial Highlights

For Q1 2024, Zeta reported revenues of $195 million, marking a 24% increase compared to the same period last year and surpassing the estimated $187.11 million. This growth was attributed to an increase in both the number of scaled customers and the expansion of ARPU among these accounts. Notably, the company's Scaled Customer count rose to 460, up from 452 in the previous quarter, and its Super Scaled Customer count increased to 144 from 131.

Despite these gains, Zeta posted a GAAP net loss of $40 million, or $0.23 per share, which includes $53 million in stock-based compensation. This loss is a decrease from the $57 million, or $0.38 per share, recorded in Q1 2023. The company also highlighted a significant improvement in cash flow from operations, which grew by 23% year-over-year to $25 million, and a 51% increase in Free Cash Flow to $15 million.

Operational and Strategic Developments

Zeta's management credited the strong quarterly performance to the enhanced capabilities of the ZMP, which is increasingly incorporating generative AI to drive customer acquisition and retention. The company's strategic focus on deepening relationships with enterprise and new agency customers has also started to yield visible financial benefits, as reflected in the raised guidance for future quarters.

Updated Financial Outlook

Encouraged by the first quarter's results, Zeta has revised its 2024 guidance upwards. The company now expects second-quarter revenue to be between $210 million and $214 million, and full-year revenue to reach between $895 million and $905 million. Adjusted EBITDA for the full year is also expected to increase, with projections ranging from $170 million to $172 million, indicating a robust year-over-year growth of 31% to 33%.

Investor and Analyst Perspectives

David A. Steinberg, Co-Founder, Chairman, and CEO of Zeta, expressed optimism about the company's trajectory, stating,

The actionable intelligence delivered by the Zeta Marketing Platform is fueling the acceleration in our business."

CFO Chris Greiner also noted,

It was a strong start to the year, highlighted by an increase in visibility from new customer wins and the rapid expansion of existing customers, which is leading to a step up in revenue and Adjusted EBITDA guidance."

Conclusion

Zeta Global Holdings Corp's first quarter of 2024 sets a positive tone for the year, with revenue growth and strategic customer expansions underscoring the effectiveness of its AI-driven marketing platform. As the company continues to innovate and capitalize on structural demand drivers, investors and stakeholders have substantial reasons to watch its progress closely.

For further details, Zeta will host a conference call and webcast to discuss the Q1 2024 financial results, accessible via the company's investor relations website.

Explore the complete 8-K earnings release (here) from Zeta Global Holdings Corp for further details.

This article first appeared on GuruFocus.