Student Loan Pause Ends June 30 — Here’s Why You May Not Have to Start Paying Immediately

After more than three years of having their payments paused as part of COVID-19 relief efforts, federal student loan borrowers will soon have to resume payments. Exactly when remains unknown, even though the official date that sticks in everyone’s mind is June 30, 2023.

Student Loan Forgiveness: 10 Expenses To Cut From Your Budget When Payments Resume

Find: All of the States That Will Pay Off Your Student Loans

The way things look now, you almost certainly won’t have to begin repaying your loans on June 30. That’s the deadline the U.S. Department of Education set in a November 2022 press release — but with stipulations. Payments are due to resume on June 30 only if the Biden administration’s federal student loan forgiveness program has been implemented and litigation involving it has not been resolved, according to the Education Department.

Of course, those two things haven’t happened. The forgiveness plan, announced in August 2022, has not been implemented. And litigation is far from being resolved. The case is currently being reviewed by the U.S. Supreme Court and many experts believe the court will rule against the forgiveness plan. A decision is expected in June, Forbes reported.

The latest extension of the payment pause — the eighth so far — is set to expire 60 days after either June 30, or whenever the Supreme Court decides on the loan forgiveness plan. Based on that deadline, payments are likely to resume sometime in late August 2023.

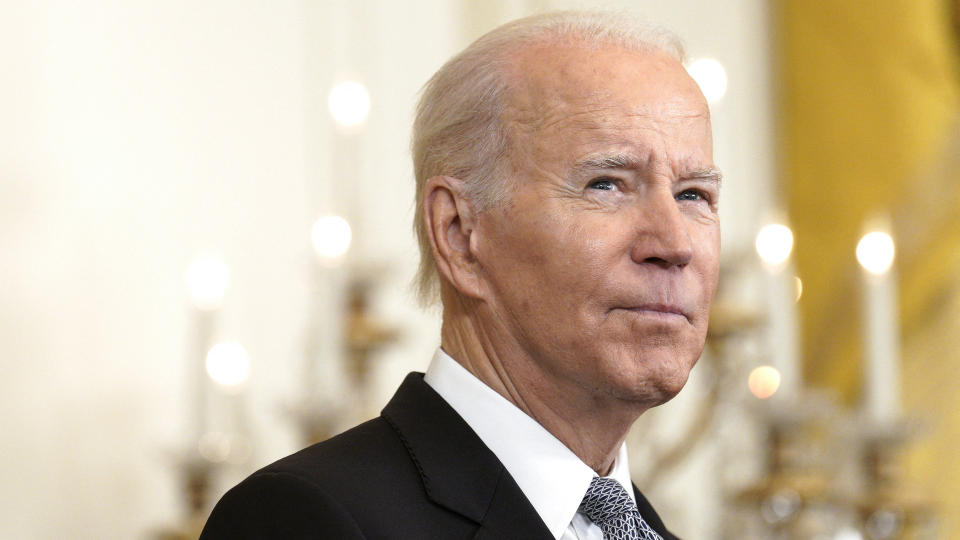

The wild card is what the Biden administration will do in case the forgiveness plan is killed. As previously reported by GOBankingRates, President Joe Biden could decide to extend the payment pause a ninth time or even pause payments indefinitely.

If he chooses that route, he’ll probably face a huge pushback from lawmakers, mainly Republicans, who oppose both the forgiveness plan and any attempts to further delay the resumption of payments.

Biden’s forgiveness plan uses the Heroes Act of 2003 — enacted in the wake of the Sept. 11 attacks — as the authority granting student loan relief. The act grants certain powers in the event of war or national emergency. In this case, the national emergency was the COVID-19 pandemic. But with the COVID emergency due to end on May 11, 2023, the authority to cancel student loan debt under the Heroes Act also ends.

“This authority is intended to be temporary and is in effect only for as long as the national emergency is in effect,” student loan expert Mark Kantrowitz wrote in a January blog on The College Investor site. “As soon as the President rescinds the national emergency declaration, the authority for a payment pause and interest waiver will end.”

Next: New Student Loan Forgiveness Rule Simplifies Process — Who Qualifies?

Even so, the Education Department is considering a transition period that would push the payment pause at least into the fall, Politico reported. Documents obtained by Politico show that department officials have told loan servicers to prepare to begin charging interest on federal loans in September. The documents also show that officials are eyeing October as the first month in which any borrower will be required to make a payment.

More From GOBankingRates

I Lost $400K of My Retirement Savings in a Roth 401(k) -- If You're Not Careful, You Could, Too

5 Places To Live in Europe That Are So Cheap You Could Quit Your Job

This article originally appeared on GOBankingRates.com: Student Loan Pause Ends June 30 — Here’s Why You May Not Have to Start Paying Immediately